Tools & Guides

Use our range of calculators, videos and guides to get you thinking about your retirement planning

Why Choose Us?

We are independent

We are not restricted or biased in any way and can explore all options to design a solution around you.

We help and support you

We take the time and complexity out of pension & retirement planning so you don’t have to.

We know our stuff

As a Chartered firm we adhere to the highest standards of trust, capability, and professionalism within our industry.

Cash Flow Planning

Nobody knows what the future holds, but we can forecast the possibilities to minimise any surprises. The best way to manage and organise your financial planning and take into consideration all possible outcomes.

Pension Consolidation

Pension consolidation may allow you to combine some or all of your defined contribution pensions in one place. Consolidating your pension means fewer statements to keep an eye on, along with fewer and potentially lower management charges.

Pension Calculator

Use our pension calculator to help you understand how much your pension funds might be worth at retirement and what you’ll need to save to reach your target fund value.

Pension Shortfall Calculator

If you have already begun saving and have retirement income that you are trying to achieve, then this handy calculator will help you to identify any shortfalls

Tax relief calculator

Calculate the tax relief you could receive on your personal pension contributions.

Investing for your future

In our experience, the sooner you start to prepare the better, and the more likely you are to achieve the kind of retirement you aspire to.

Using your pensions

If you’ve been fortunate and/or smart enough to have put aside funds for retirement, putting these to work for your future should be an absolute priority.

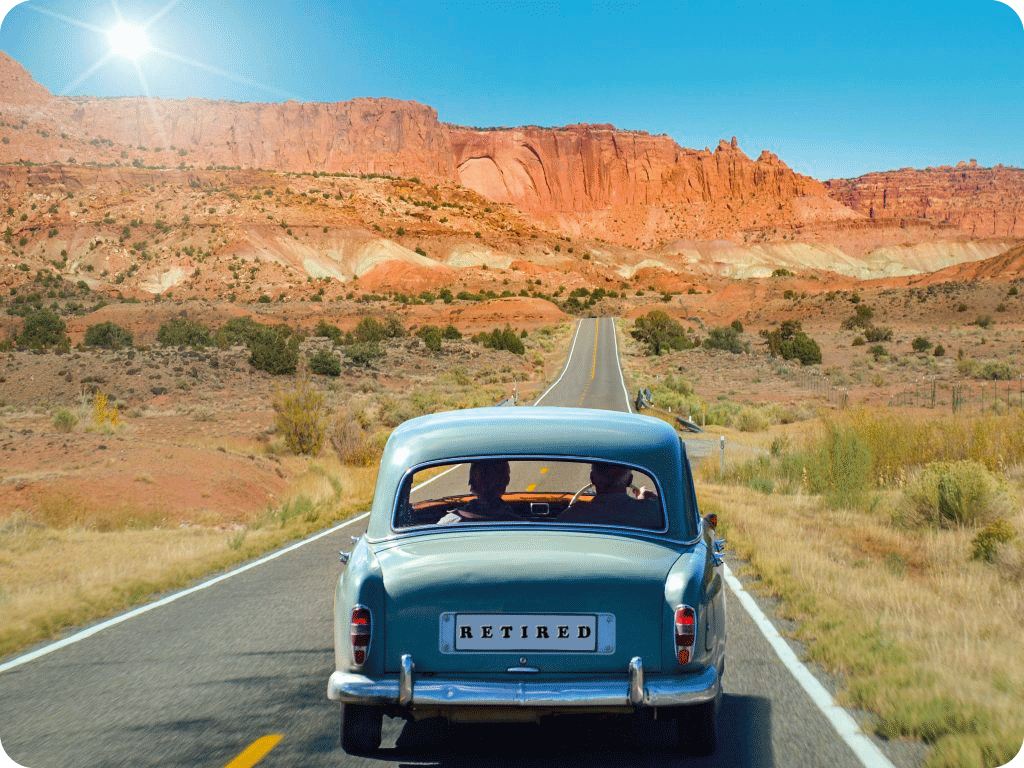

Enjoying your retirement

If you’re looking forward to enjoying some well-earned free time and flexibility, being prepared financially ahead of retirement is more important than ever.

Speak to our retirement experts

Bespoke solutions personal to you

We’ve helped many people prepare for the type of retirement lifestyle they want. Reach out to start a conversation with one of our retirement experts.